Wisconsin Sales Tax Calculator

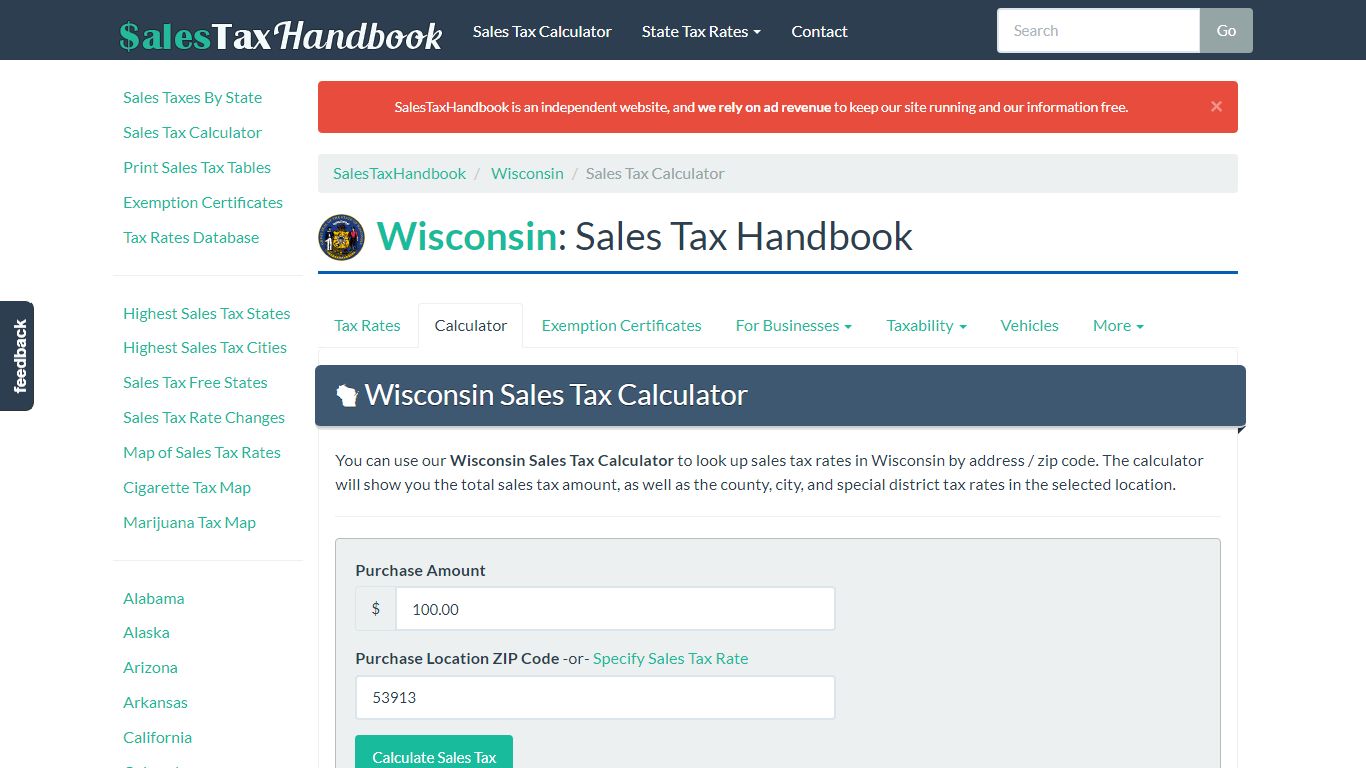

Wisconsin Sales Tax Calculator - SalesTaxHandbook

Wisconsin Sales Tax Calculator You can use our Wisconsin Sales Tax Calculator to look up sales tax rates in Wisconsin by address / zip code. The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location. Purchase Location ZIP Code -or- Specify Sales Tax Rate

https://www.salestaxhandbook.com/wisconsin/calculator

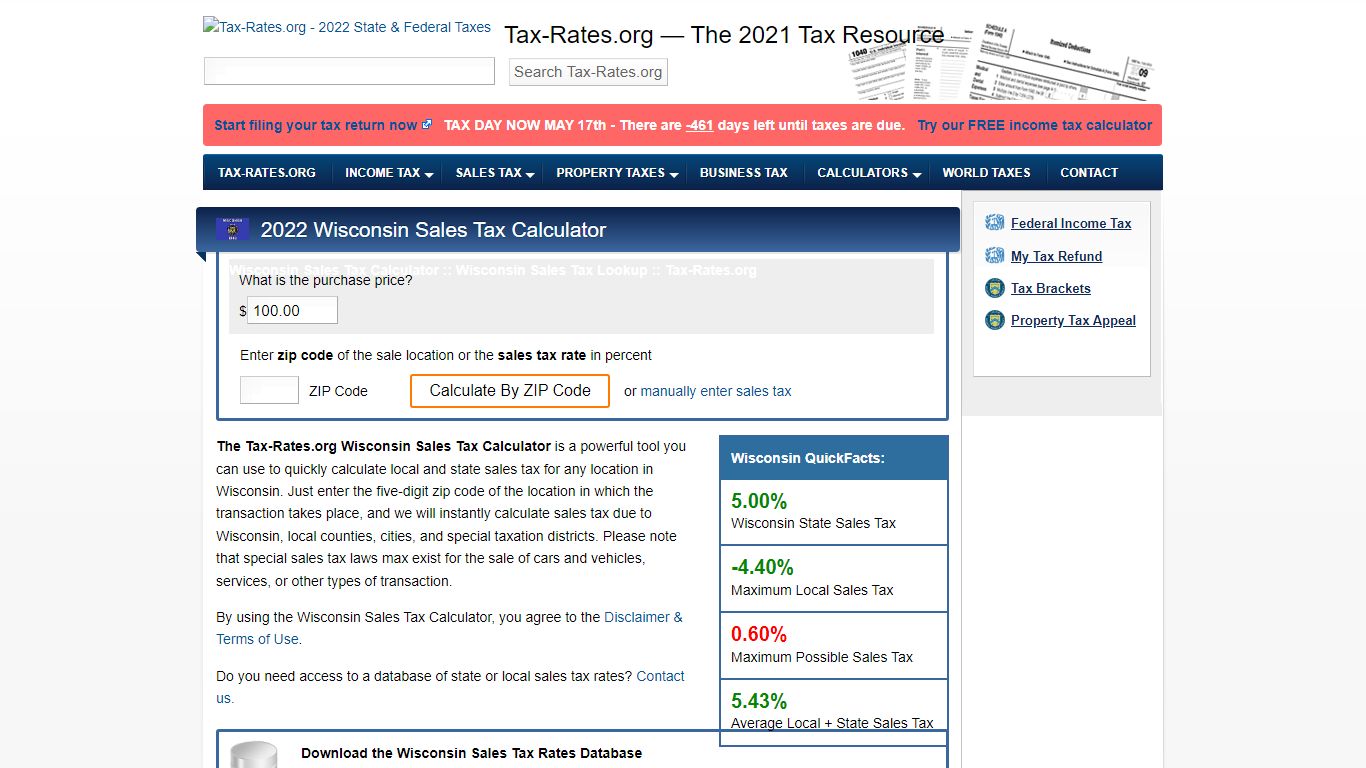

Wisconsin Sales Tax Calculator - Tax-Rates.org

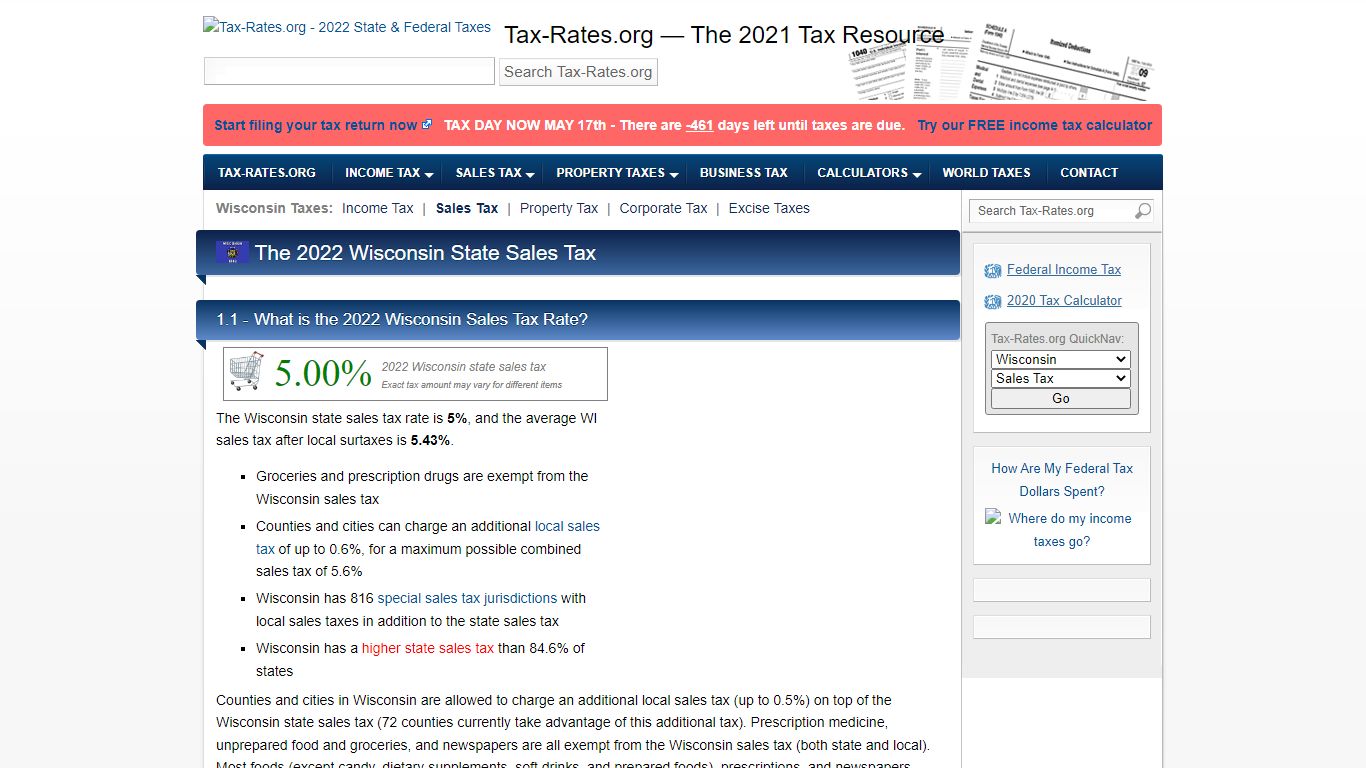

Just enter the five-digit zip code of the location in which the transaction takes place, and we will instantly calculate sales tax due to Wisconsin, local counties, cities, and special taxation districts. Please note that special sales tax laws max exist for the sale of cars and vehicles, services, or other types of transaction.

https://www.tax-rates.org/wisconsin/sales-tax-calculator

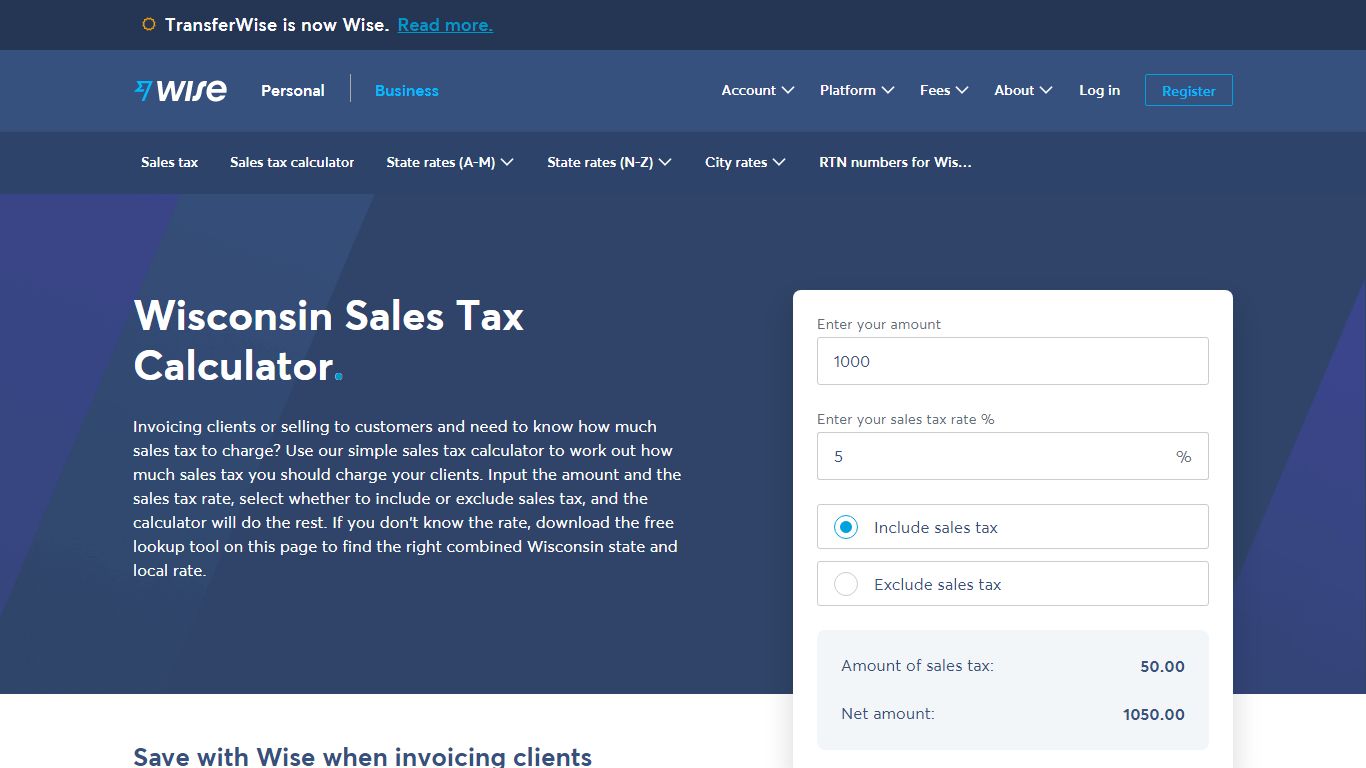

Wisconsin Sales Tax | Calculator and Local Rates | 2021 - Wise

The base state sales tax rate in Wisconsin is 5%. Local tax rates in Wisconsin range from 0% to 0.6%, making the sales tax range in Wisconsin 5% to 5.6%. Find your Wisconsin combined state and local tax rate. Wisconsin sales tax rates vary depending on which county and city you’re in, which can make finding the right sales tax rate a headache.

https://wise.com/us/business/sales-tax/wisconsin

Wisconsin Sales Tax Calculator

Just enter the five-digit zip code of the location in which the transaction takes place, and we will instantly calculate sales tax due to Wisconsin, local counties, cities, and special taxation districts. Please note that special sales tax laws max exist for the sale of cars and vehicles, services, or other types of transaction.

https://www.tax-rates.org/wisconsin/sales-tax-calculator?action=preload&price=100.00&taxrate=5.00&zip=

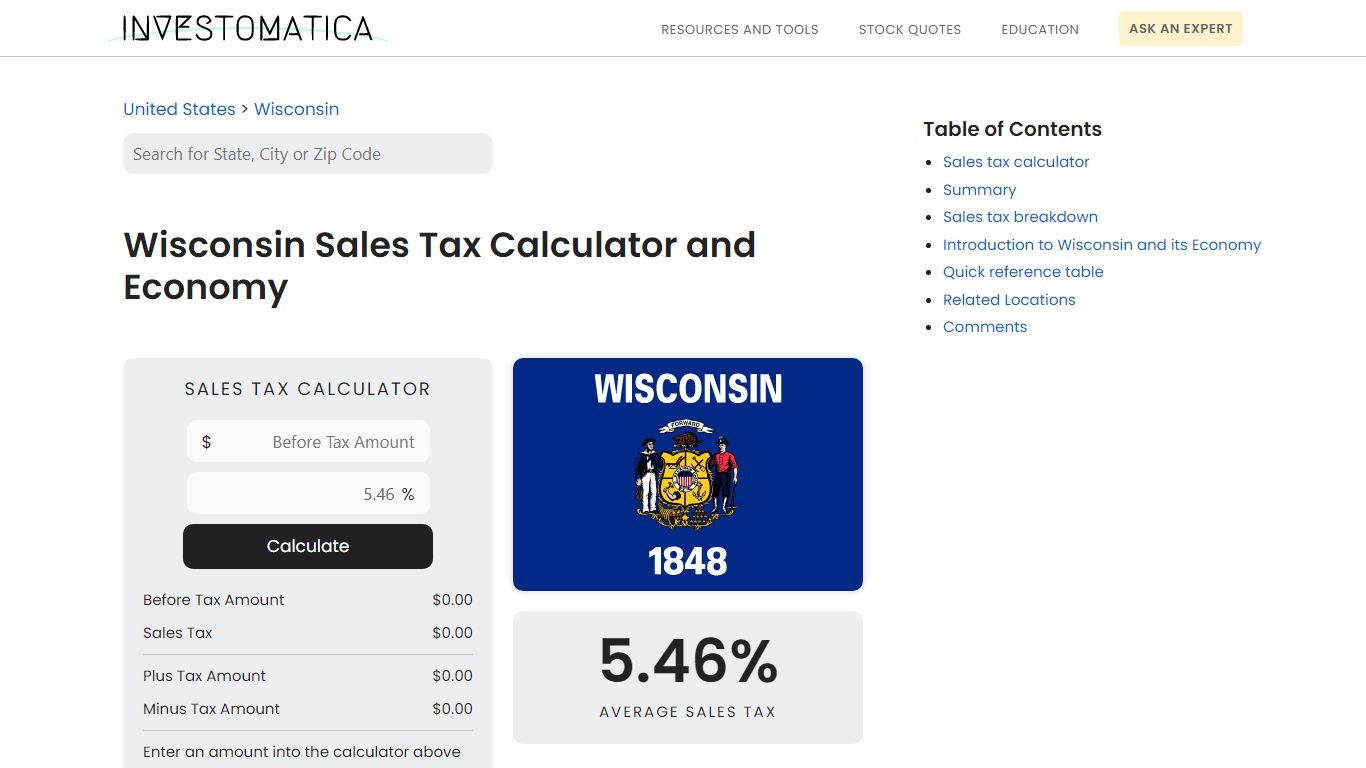

Wisconsin Sales Tax Calculator and Economy - Investomatica

Sales Tax Calculator Calculate Before Tax Amount $0.00 Sales Tax $0.00 Plus Tax Amount $0.00 Minus Tax Amount $0.00 Enter an amount into the calculator above to find out how what kind of sales tax you'll see in Wisconsin. You'll then get results that can help provide you a better idea of what to expect. 5.46% Average Sales Tax Summary

https://investomatica.com/sales-tax/united-states/wisconsin

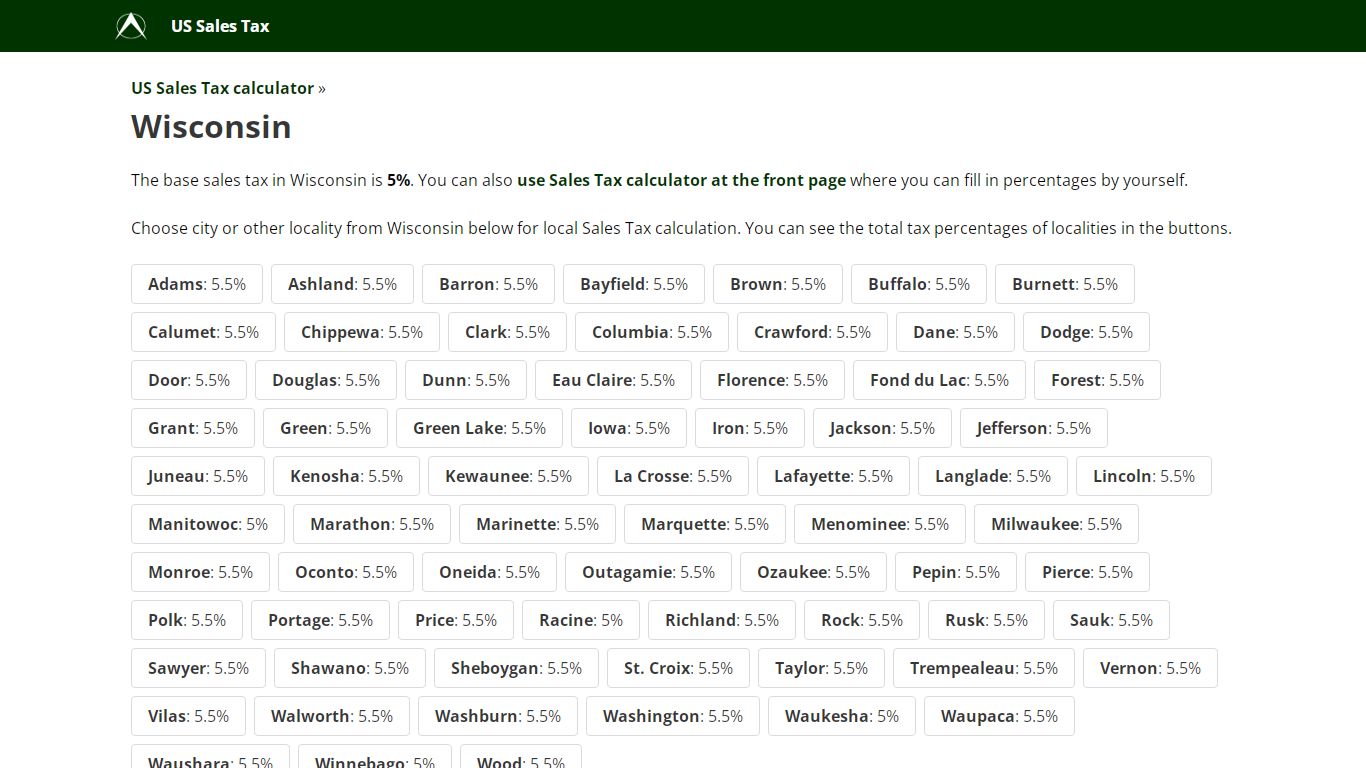

Wisconsin Sales Tax calculator, Wisconsin, US

US Sales Tax calculator » Wisconsin The base sales tax in Wisconsin is 5%. You can also use Sales Tax calculator at the front page where you can fill in percentages by yourself. Choose city or other locality from Wisconsin below for local Sales Tax calculation. You can see the total tax percentages of localities in the buttons.

https://vat-calculator.net/us-sales-tax/wisconsin

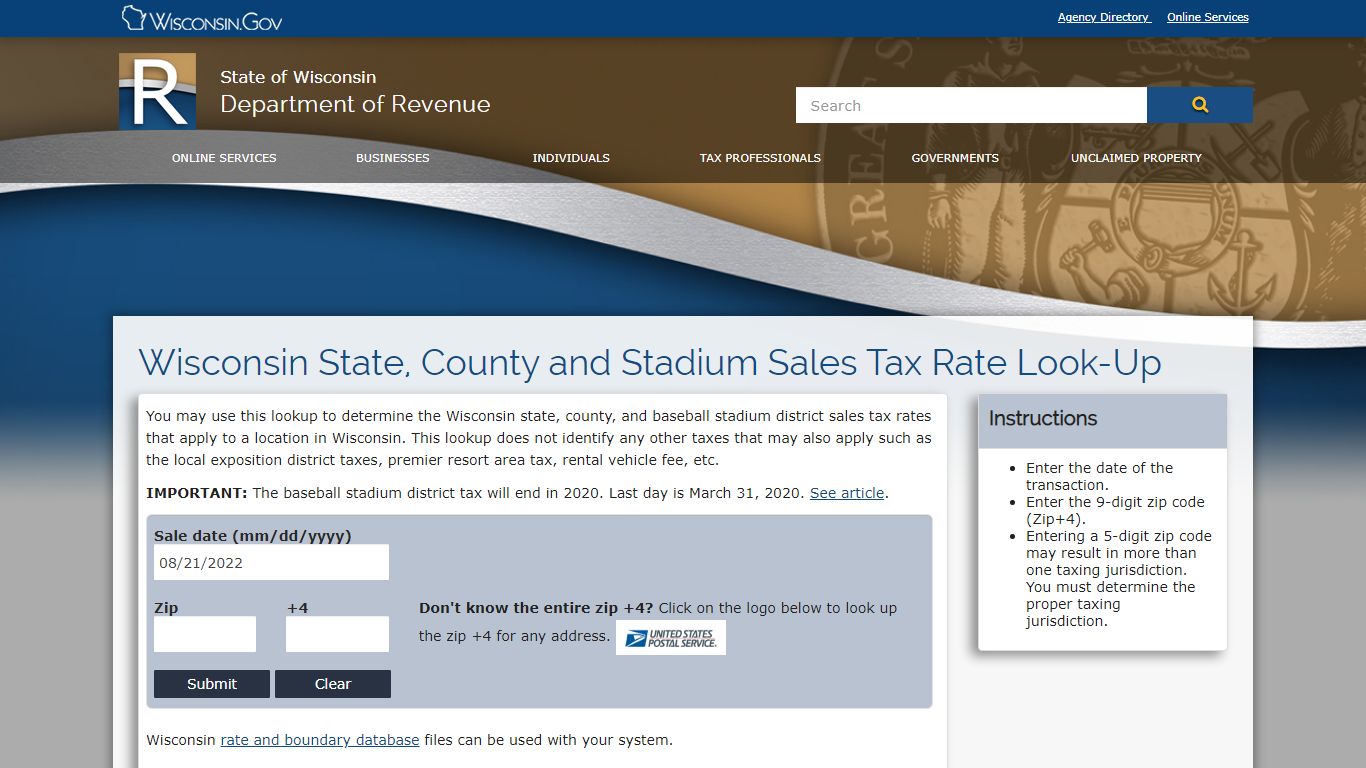

Wisconsin State, County and Stadium Sales Tax Rate Look-Up

Wisconsin rate and boundary database files can be used with your system. Instructions Enter the date of the transaction. Enter the 9-digit zip code (Zip+4). Entering a 5-digit zip code may result in more than one taxing jurisdiction. You must determine the proper taxing jurisdiction.

https://www.revenue.wi.gov/Pages/Apps/strb.aspx

DOR Sales and Use Tax - Wisconsin

Wisconsin Department of Revenue: Sales and Use Tax. Assessors, Businesses, Manufacturing, Municipal Officials: 2022: 6/13/2022: 2022 Preliminary Manufacturing TID Report

https://www.revenue.wi.gov/Pages/SalesAndUse/Home.aspx

Wisconsin Sales Tax Rate - 2022

Wisconsin Sales Tax Calculator Purchase Details: $ in zip code Enter the zip code where the purchase was made for local sales tax Whenever you make a purchase at a licensed Wisconsin retailer, your sales tax will be automatically calculated and added to your bill. To lookup the sales tax due on any purchase, use our Wisconsin sales tax calculator .

https://www.tax-rates.org/wisconsin/sales-tax

Milwaukee, Wisconsin Sales Tax Calculator (2022) - Investomatica

Enter an amount into the calculator above to find out how what kind of sales tax you'll see in Milwaukee, Wisconsin. You'll then get results that can help provide you a better idea of what to expect. 5.5% Average Sales Tax Summary The average cumulative sales tax rate in Milwaukee, Wisconsin is 5.5%.

https://investomatica.com/sales-tax/united-states/wisconsin/milwaukee

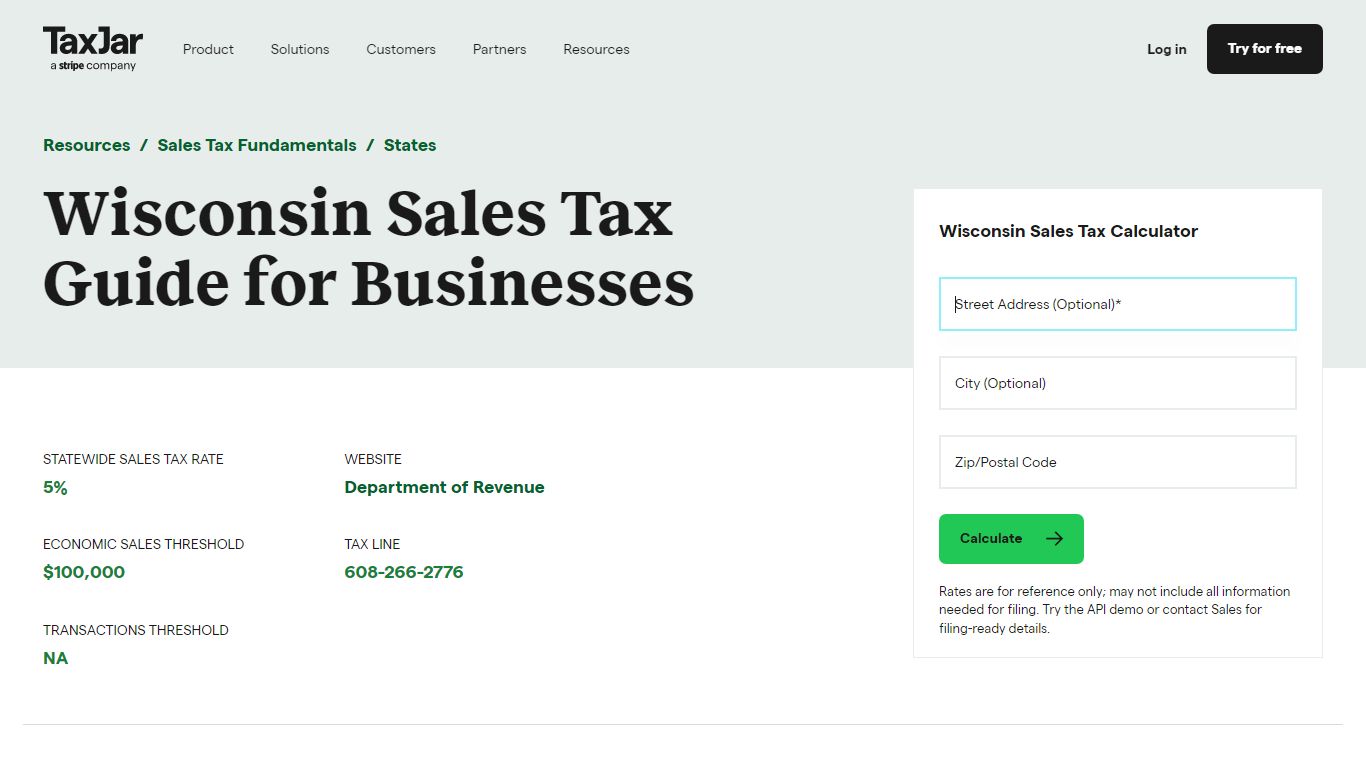

Wisconsin Sales Tax Guide and Calculator 2022 - TaxJar

Your other option is to fill out the BTR-101, the Application for Wisconsin Business Tax Registration. After you do, send it to: Wisconsin Department of Revenue. PO Box 8902. Madison, WI 53708-8902. (608)266-2776. FAX: (608) 264-6884. You need this information to register for a sales tax permit in Wisconsin:

https://www.taxjar.com/sales-tax/wisconsin